A Guide to Enhancing Investment Performance Reporting with Technology

7 May 2023 Igor Rodionov

In this article, readers will gain valuable insights into the vital role that investment performance reporting plays in the finance world. The article explores the significance of accurate and timely investment performance reporting, along with the challenges which can be solved with technology. As a solution to these challenges, the article introduces DynamicDocs API and DynamicDocs Excel Add-in, illustrating how technology can transform investment performance reporting. By utilizing the power of these tools, readers will learn how to optimize their investment reporting processes, ultimately leading to better decisions as well as improved marketing efforts for their firms.

What is Investment Performance Reporting?

Investment performance reporting is the process of gathering, analyzing, and presenting financial data related to an investment portfolio's performance over a specific period of time. The primary objective of investment performance reporting is to provide investors, asset managers, and financial advisors with a clear and comprehensive understanding of how their investments have performed, allowing them to make informed decisions about the management of their portfolios.

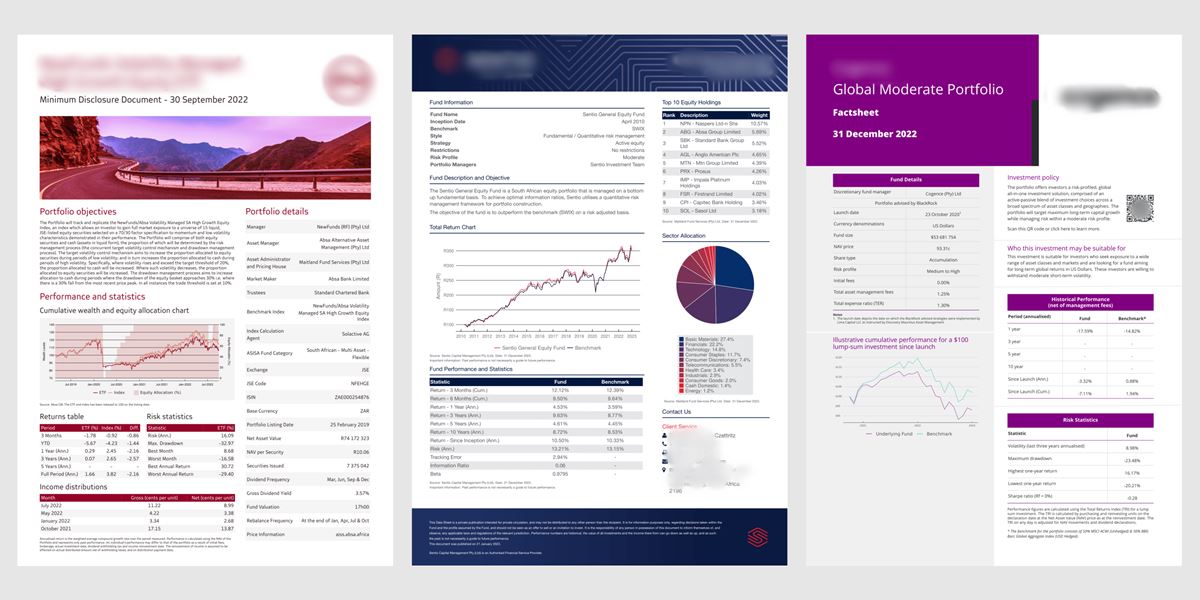

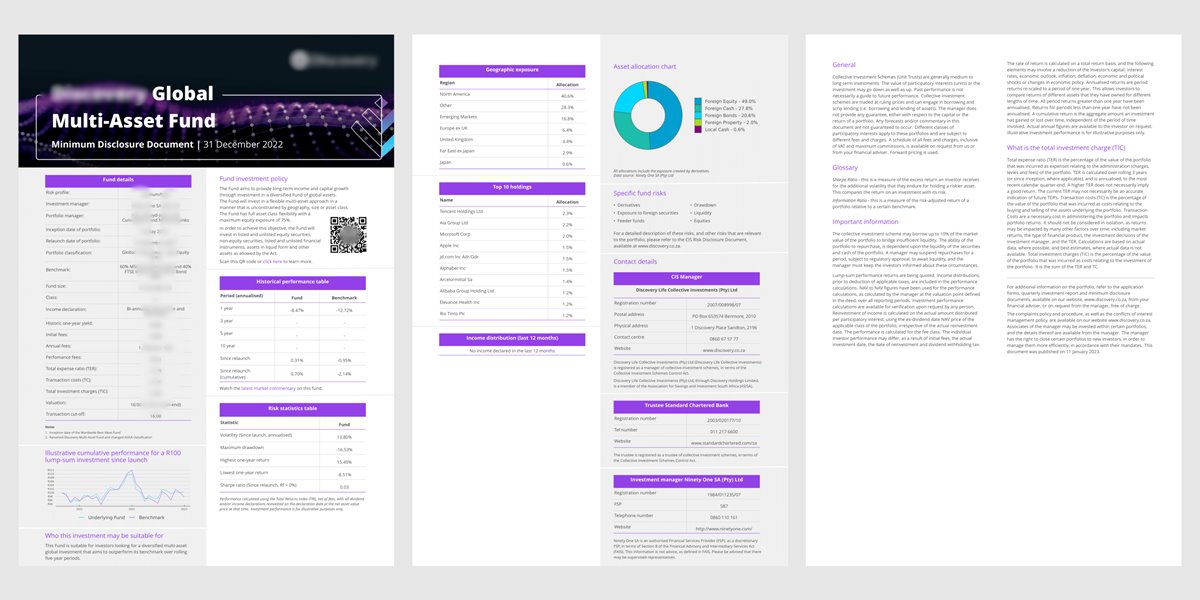

These reports typically include various performance metrics, such as rates of return, volatility, risk-adjusted performance, and benchmark comparisons, among others. These metrics offer insights into the investment's gains, losses, and overall performance relative to the market and its peers. Investment performance reports also provide a detailed breakdown of the portfolio's asset allocation, sector exposure, and individual holdings, enabling investors to assess the diversification and risk management strategies in place.

Investment performance reporting is essential for various reasons. It helps investors monitor the progress of their investments toward achieving their financial goals, provides transparency and accountability between clients and investment professionals, and ensures regulatory compliance for investment firms. By delivering accurate and timely investment performance reports, financial professionals can build trust with their clients, demonstrate the effectiveness of their investment strategies, and make data-driven decisions to optimize their portfolios for better financial outcomes.

Challenges in Traditional Reporting Methods

Traditional reporting methods in the investment performance reporting field have faced several challenges that can hinder the effectiveness of the reports. These challenges stem from the limitations of manual processes, data management issues, and the lack of real-time information, among other factors.

One of the most significant challenges in traditional reporting methods is the manual compilation of data. Gathering and organizing data from multiple sources, such as market data providers, custodians, and internal systems, can be a time-consuming and labor-intensive process. Manual data entry and handling also increase the likelihood of human errors, which can lead to inaccuracies in the reports. These inaccuracies may result in misinformed decisions, negatively impacting the value of performance reporting.

In addition, traditional reporting methods often suffer from inconsistencies in data presentation and formatting. Due to the variety of data sources and the absence of standardized reporting templates, it can be difficult to ensure clear communication. This lack of consistency may hinder the ability to identify trends, spot potential risks, and evaluate the performance of various investment strategies effectively.

Another challenge faced by traditional investment performance reporting methods is the difficulty in providing real-time or near-real-time data. In the rapidly changing financial markets, access to up-to-date information is crucial for making timely investment decisions. Traditional reporting methods, however, often involve periodic updates, which may not capture the most recent market developments. This lag in information can lead to missed opportunities and late information.

Lastly, traditional reporting methods may not provide sufficient customization options to meet the unique needs and preferences of individual investors or financial professionals. With an increasing demand for personalized financial advice and tailored reporting, the limitations of traditional methods can create a barrier to delivering the level of service expected by clients in today's competitive landscape.

Overall, the challenges posed by traditional investment performance reporting methods highlight the need for more advanced, technology-driven solutions that can streamline the reporting process, and provide timely, customizable information to support better decision-making and investment outcomes.

API for Investment Performance Reporting

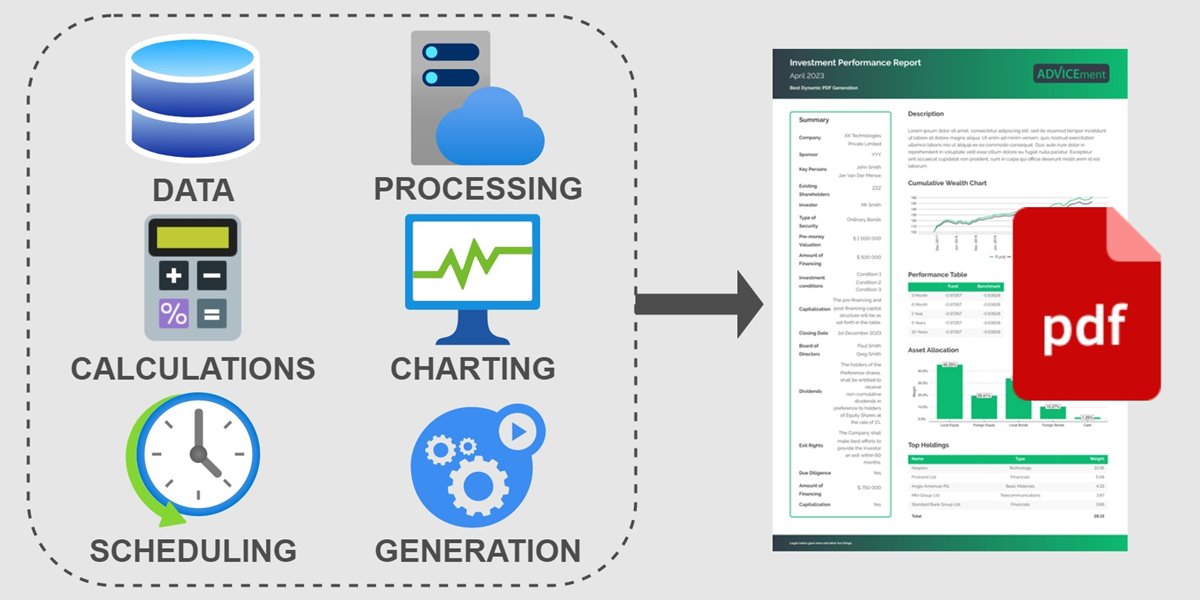

DynamicDocs API offers a powerful solution that tackles the challenges associated with investment performance reporting while incorporating best practices (see section on the best practices below). By leveraging the professional document typesetting capabilities of LaTeX and the flexibility of JSON data, DynamicDocs API provides a versatile and efficient tool for generating investment performance reports.

Data consistency and integrity are maintained through in-template calculations, minimizing errors and inconsistencies. The API's easy integration with with third party platforms ensures reliability, fostering trust among clients and promoting informed decision-making.

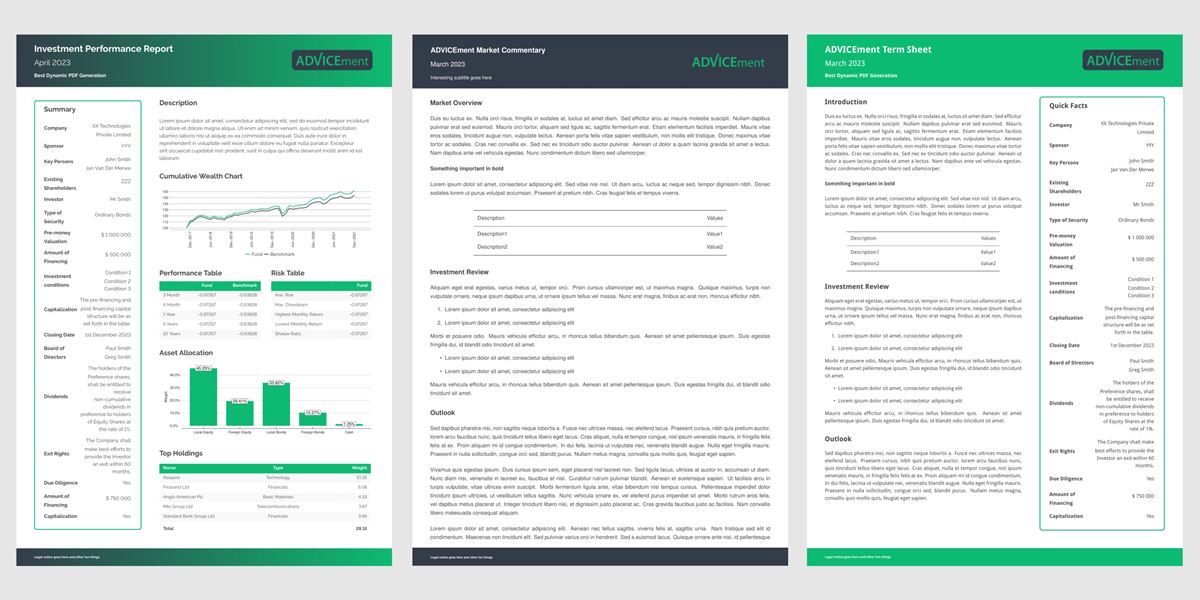

Clear and concise visualizations are easily created using the API's LaTeX foundation, allowing for seamless integration of well-designed and dynamic charts and tables. This enhances readability and comprehensibility, while customizable templates and adjustable timeframes cater to clients' unique needs and preferences, resulting in increased engagement and satisfaction.

By supporting calculations within the template, the API allows for the integration of risk metrics and actionable insights directly into investment performance reports. Financial professionals can effortlessly incorporate risk assessments and data-driven recommendations, empowering clients to make more informed decisions about their portfolios.

Overall, DynamicDocs API serves as an innovative and flexible solution for investment performance reporting. It fully customises the reports, enables clear visualizations, and automates report generation, delivering engaging, accurate, and valuable insights to clients. Financial professionals can thus enhance their reporting process and provide a superior experience to their clients.

Investment Performance Reporting From Excel

DynamicDocs also offers a PDF generating Excel Add-in that complements its API capabilities, providing users the convenience of generating investment performance reports directly from their Excel spreadsheets. This feature is especially beneficial when data is readily available or accessible in Excel, offering a time-efficient solution for performance teams in specific scenarios.

Seamless integration with Excel allows users to leverage the familiar spreadsheet environment while producing professional-grade reports. Within a matter of seconds, users can transform their spreadsheet data into comprehensive and visually engaging investment performance reports, optimizing their workflow.

The Excel add-in also retains the customizability of DynamicDocs API, providing flexibility in tailoring reports to meet clients' unique needs and preferences. Users can create personalized templates, choose specific metrics, and modify timeframes for analysis directly within Excel, ultimately enhancing client engagement and satisfaction.

While the DynamicDocs Excel add-in involves manual processes, it remains a valuable and user-friendly solution for performance teams seeking an efficient method to create reports from Excel data. By integrating the robust features of DynamicDocs API with the accessibility and familiarity of Excel, financial professionals can streamline their reporting process and deliver an improved client experience.

Best Practices for Effective Investment Performance Reporting

As the landscape of investment reporting evolves, adopting best practices becomes increasingly essential to delivering valuable, accurate, and engaging reports. This section outlines several key best practices for effective investment performance reporting, focusing on data consistency and integrity, clear and concise visualizations, regular updates and monitoring, and additional strategies to enhance the overall quality and impact of the reports. By embracing these best practices, performance teams can better serve their clients, foster trust, and improve the firm's marketing drive.

Data Consistency and Integrity

Ensuring data consistency and integrity is vital for effective investment performance reporting. Establishing standardized data collection, management, and reporting processes helps minimize errors and discrepancies. Implementing technology-driven solutions, such as data aggregation tools and automated reconciliation processes, streamlines data management and guarantees accurate, complete, and up-to-date information, fostering trust among clients and supporting informed decision-making.

Although DynamicDocs API doesn't assist with data consistency and integrity, we do recommend using Linx, a low code platform specifically developed for these tasks. See our article, No More PDF Generation Headaches with Linx and DynamicDocs API for further discussion.

Clear and Concise Visualizations

Using clear and concise visualizations, like well-designed charts, graphs, and tables, greatly enhances the readability and comprehensibility of reports. Carefully selected visual elements showcase key performance metrics, trends, and comparisons, allowing investors to easily understand the information. Including concise captions and annotations further clarifies the data, leading to improved client engagement and informed decision-making.

Regular Updates and Monitoring

Providing regular updates and monitoring is essential for timely and informed decision-making. Adopting a predefined reporting schedule, such as monthly, ensures consistent communication. In addition to scheduled updates, ongoing data monitoring helps identify significant changes, potential risks, or emerging opportunities that warrant immediate attention, ultimately resulting in improved investment outcomes.

Flexibility and Customization

Incorporating flexibility and customization in investment performance reports significantly enhances the user experience for clients. By offering options to tailor reports to individual preferences, financial professionals can provide clients with the most relevant and valuable information. This can include customizable templates, the ability to select specific metrics, and adjustable timeframes for analysis, leading to increased client engagement and satisfaction.

Clear Communication and Context

Clear communication and context are crucial for effective investment performance reporting. Financial professionals should use simple, concise language to explain market movement, avoiding jargon and confusing technical terms. Providing context for performance metrics, such as historical comparisons or industry benchmarks, helps clients better understand their portfolio's performance implications and comprehension.

Integration of Risk Metrics

Integrating risk metrics into investment performance reports offers clients a more comprehensive understanding of their portfolio's performance. Assessing not just returns but also associated risks enables deeper insight into investment strategies and potential trade-offs. Risk metrics, including standard deviation, value at risk (VaR), and risk-adjusted performance measures like the Sharpe ratio, facilitate more informed decision-making based on a holistic view of investments.

Emphasizing Actionable Insights

Focusing on actionable insights in investment performance reports enables clients to make informed decisions about their portfolios. Financial professionals should highlight key takeaways, assisting clients in identifying areas of improvement, potential risks, and new opportunities. By emphasizing actionable insights, financial professionals ensure that their investment performance reports not only inform clients but also empower them to take meaningful actions towards achieving their financial goals.

Conclusion and Future Developments

As the landscape of investment performance reporting continues to evolve, the demand for innovative and interactive reporting solutions is set to grow. One of the key developments in the future of investment performance reporting is the incorporation of moving elements within reports, which can effectively showcase the evolution of investments over time or visualize changes in allocation from month to month. At ADVICEment, we are dedicated to staying at the forefront of these advancements and are actively working on incorporating these dynamic features into DynamicDocs API.

Another crucial aspect of the future of investment performance reporting is the emphasis on personalization. Tailoring reports to individual clients' needs and preferences ensures that they receive the most relevant and valuable information, ultimately enhancing engagement and satisfaction. The DynamicDocs API already supports a personalized approach to investment performance reporting, providing fully customizable templates, the ability to select specific metrics, and adjustable timeframes for analysis. As we continue to develop our platform, we aim to refine and expand upon these personalization capabilities, offering even more options for financial professionals to cater to their clients' unique requirements.

In conclusion, the future of investment performance reporting is moving towards more dynamic and personalized solutions, and we are committed to being a leading force in driving these advancements. By continuously improving our platform to include cutting-edge features and ensuring a tailored approach to reporting, we strive to empower financial professionals with the tools they need to deliver engaging, accurate, and valuable insights to their clients in the ever-evolving world of finance.